The trigger for XLM’s price hike on Tuesday was a press release from Latin America’s largest cryptocurrency exchange, Mercado Bitcoin.

Reaction to collaboration between Stellar and Mercado Bitcoin

The site’s customers have gained access to a stable USD Coin token issued on Stellar’s blockchain. The network provides commissions in fractions of a cent on coin transactions pegged to the USD exchange rate.

The stablecoin is issued by Circle, which publishes weekly reports on the composition of assets in the USDC security fund. The USD Coin token is 30% fiat covered, with 70% of the fund placed in US Treasury bonds eliminating the deprivation risks that brought to ruin the Terra ecosystem, where the UST stablecoin circulated, in May.

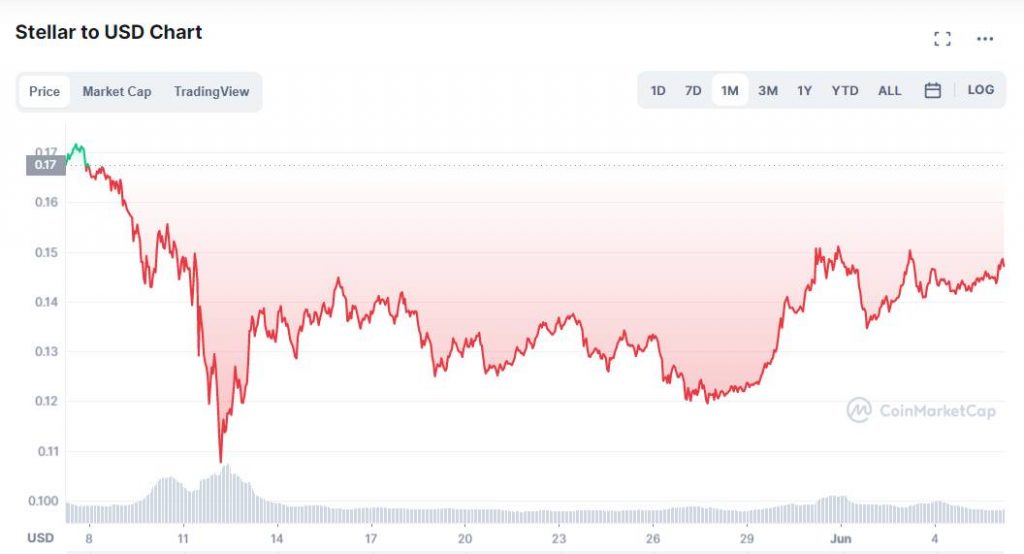

Investors’ strong reaction to the news related to Stellar and Mercado Bitcoin is due to plans for a long-term collaboration between the cryptocurrency’s developers and the exchange. Earlier they began working together on one of the digital real projects, under the auspices of the Central Bank of Brazil. The moment of cooperation launched a rising trend that has lifted XLM quotes by 22% within the last 2 weeks (27.05-06.06).

Bitcoin cash (BCH) – a growth indicator for the crypto market

The rise in Bitcoin Cash quotes for the period 29.05-01.06 has arbitrage reasons. The largest Bitcoin clone, as usual, showed a deeper drawdown relative to the main cryptocurrency in May.

Given the fact that the blockchain code is similar, investors view BCH as a relatively safe asset that is relatively widely traded on exchanges and retail payments. This gives arbitrageurs a reason to “buy back” the divergence by betting on dynamic flattening.

The emergence of stronger growth trends for BCH relative to BTC could be seen as an indirect signal of future growth in the cryptocurrency market. Otherwise, arbitrage trades are doomed to fail. When the market falls, BCH always outperforms Bitcoin in terms of value loss.