The price of Stellar lumens has grown XX% in 2020, and it has the potential to grow further. Here’s what you need to know about this very attractive and undervalued coin.

What is special about Stellar?

Stellar (actually, lumens) is a cryptocurrency created in 2014 by the founder of Ripple, Jed McCaleb. Here are the key advantages of XLM:

- Low fees: each transaction costs just xx. Compare this to Ethereum, where the transaction fee is currently $2.8.

- Speed: it takes only a few seconds to confirm a transaction – as opposed to 30min – 1 hour on the Bitcoin network.

- Designed for fiat transfers: with Lumens, it’s easy to tokenize any asset, such as USD, euro etc. In fact, the blockchain was developed for cross-border payments. The only thing that’s required are white-listed institutions that will exchange fiat into Stellar tokens and back.

- Easy to launch assets: anyone can create a new token on the Lumens blockchain almost for free.

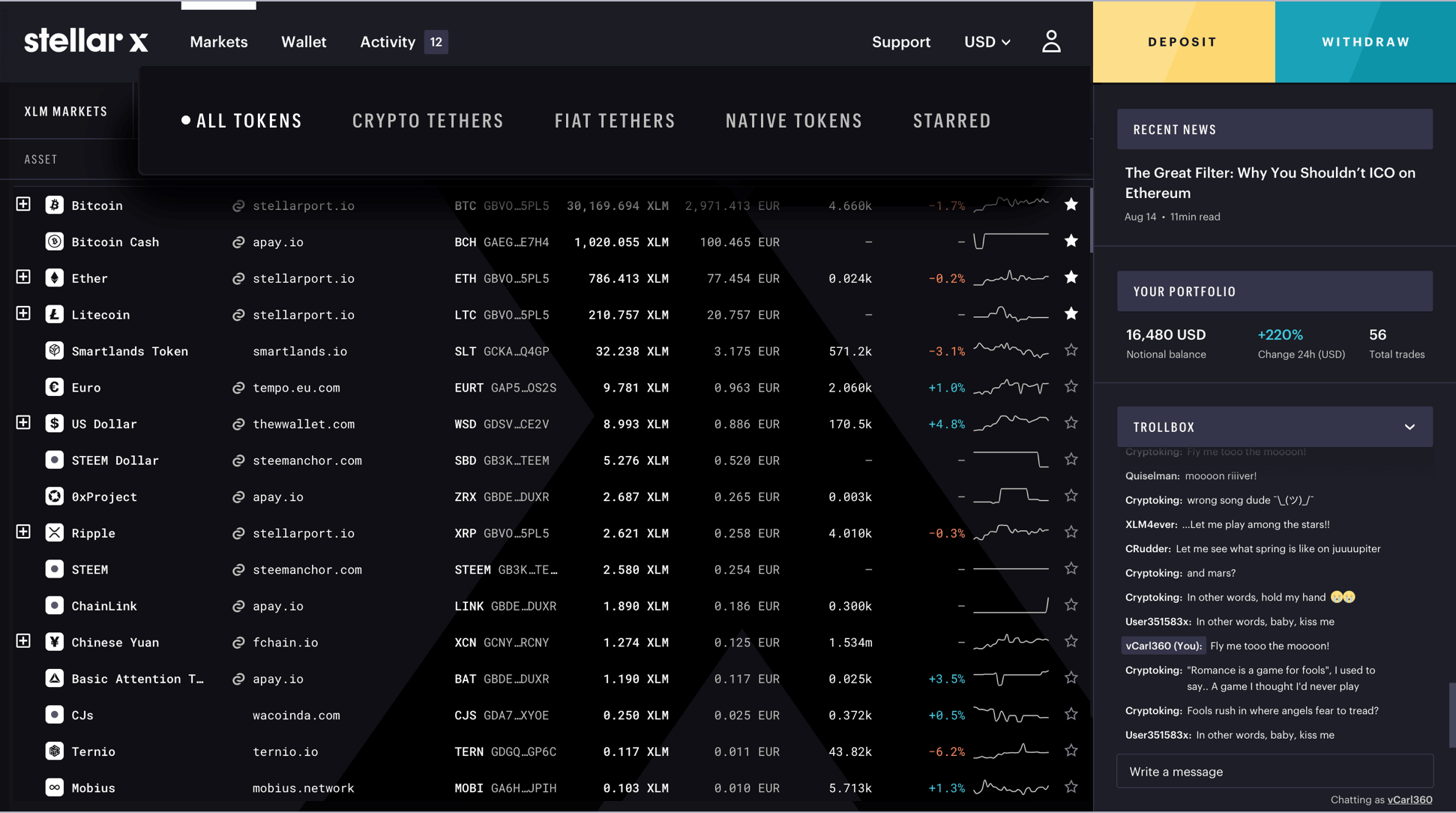

- Built-in exchange: the coin even has its own decentralized exchange – fast, free, and with fiat support. You can access the DEX through the graphic interface StellarX.

What’s the total supply of XLM?

Initially Stellar was launched with a supply of 100 billion coins, managed by the Stellar Development Foundation. Out of these 100bn, 68 billion were allocated for airdrops and giveaways for the users. There was also an annual inflation rate of 1%.

However, the community was concerned about the effect that such a large and growing supply could have on the price. Many also said that the fact that the Foundation controlled 85% of the supply was bad for lumens’ reputation. In October 2019 the inflation mechanism was removed. In November 2019 the Foundation took an even more drastic measure: it burned 55 billion coins, stating that the value of giveaways was decreasing. As of September 2020, the Foundation controls circa 60% of all XLM (30bn lumens), with 20bn circulating in the market.

Can you mine Stellar?

The coin doesn’t use the Proof-of-Work consensus algorithm like Bitcoin or Ethereum, so you cannot mine it. It doesn’t use Proof-of-Stake, either. Lumens has its own unique consensus model known as SCP, developed by the Stanford professor of computer science David Mazieres. SCP is considered one of the most secure and stable consensus algorithms among all cryptocurrencies. In fact, the Lumens blockchain has never been successfully attacked.

2020: the year of partnerships

This year has been very good for Stellar so far. The Development Foundation signed several high-profile partnership agreements: with the banking app Abra, B2B payment solution SatoshiPay, and risk management platform Elliptic Inc. Stellar was also integrated into the Samsung Blockchain Store – a key management solution used in Galaxy phones.

As for price action, Lumens has already appreciated by 71% in 2020, from $0.044 to $0.077. By the way, lumens’ major rival, XRP, has grown only 21% in the same period.

Should you invest in Stellar right now?

Even though XLM is already worth 70% more than it was in January 2020, it still has a lot of potential. 12-month targets offered by analysts vary from $0.09 (+17%)to $0.146 (+90%).

Lumens is still undervalued, mostly because investors’ attention has been focused on DeFi assets and protocols, such as Compound, Balancer, and Yearn Finance. However, as the DeFi industry is struggling with ever-growing gas fees, the spotlight is moving back to more traditional and reliable assets, including Lumens. A new Bitcoin rally in the next couple of months could also push the price of lumens up.

Summing up

Overall, Stellar is a very interesting cryptocurrency that offers real value to users thanks to its fast, scalable and almost-free transactions. At the same time, it’s a good buying opportunity, as it could still appreciate by over 15% until the end of the year and by as much as 90% in 12 months.